With COVID-19 mostly moving into the rearview mirror, 2022 was a year of rebirth. The pandemic created an artificial app boom (especially for games) and as it abated so did market momentum. Then again, the pandemic also put much of regular life on hold (or at half pace) and with things returning to normal, the pace of business should pick up.

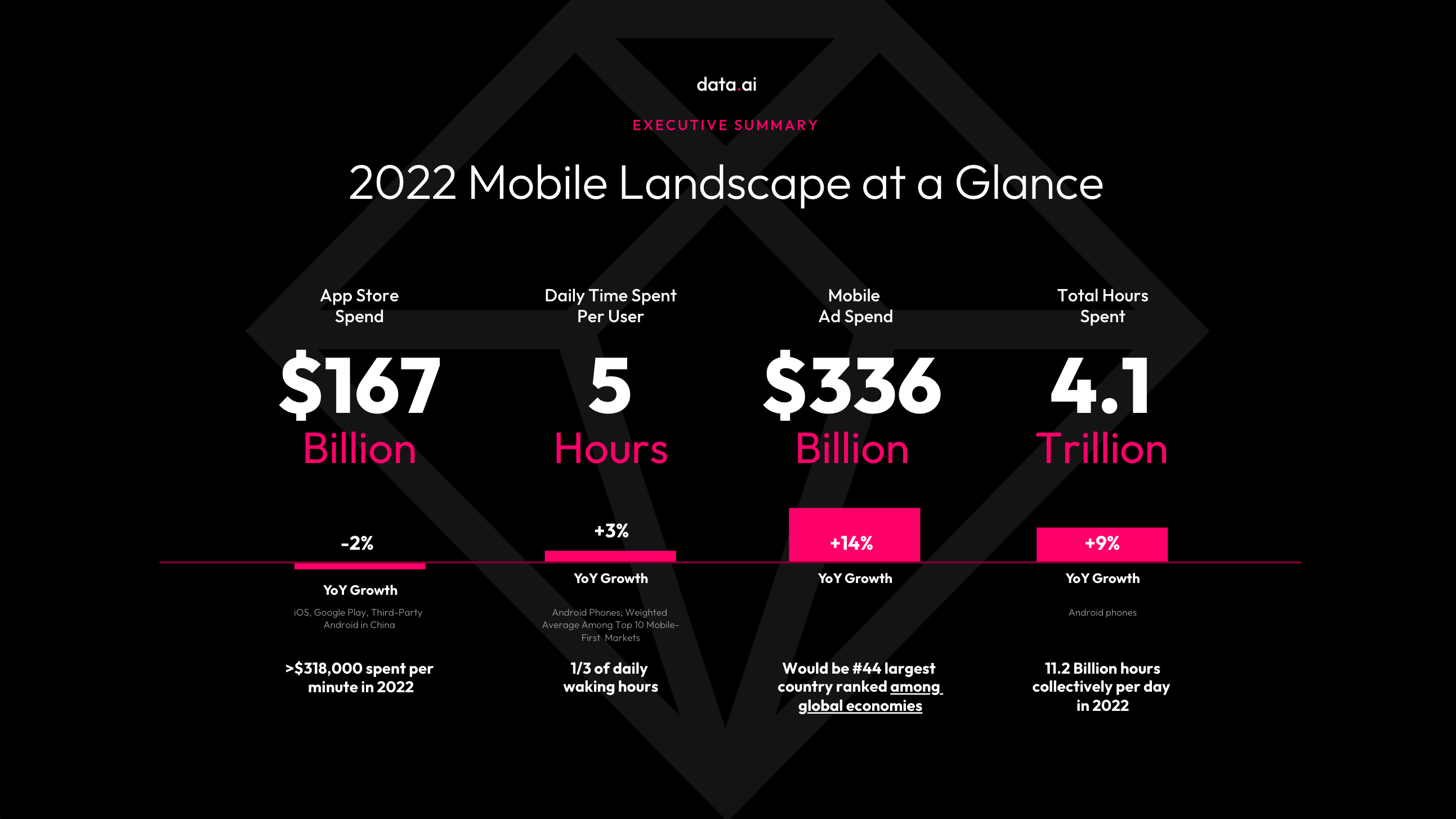

So the year was marked by both downward and upward pressures. And the fact that 2022 produced something of a mixed bag for the market should come as little surprise. Usage reached an all time high and ad spend continues to grow at a healthy rate. At the same time, installs appear to be leveling off (142B total downloads in 2022, compared to 143B in 2021) and consumer spending has taken a step backward for the first time.

But when we look back at the year that was to unpack the trends and dig into market data, our interest isn’t really about what happened so much as it’s about what will happen going forward. App makers are scrutinizing the data trail in hopes of uncovering trends they can project forward and use to inform on their business strategies. In that respect, the mixed bag certainly adds intrigue.

And if the trajectory of things wasn't already sufficiently opaque, do bear in mind that (by most indications) the global economy is entering recession. Reading the tea leaves has perhaps never been more difficult. And never more needed.

Define the Trend, Dominate the Trade

The new year brings a chance to reflect on the past and plan for the future. It's a time to take stock of where you are in relation to your long-term goals and to make adjustments accordingly. Looking at the latest trends and mapping how they impact the business landscape in general and your business strategy in particular is a big part of it.

To help with that, we've compiled a list of some of the top trends that emerged in 2022.

TREND NO 1: UA is becoming considerably more difficult

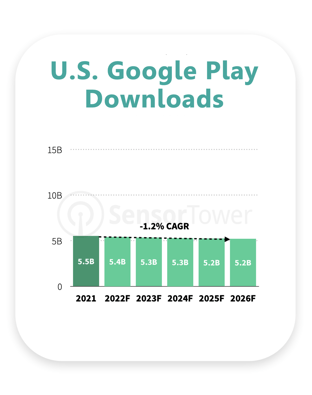

Coming down from the pandemic high of cheap installs and a seemingly unlimited user base with endless reserves of time they’re happy to spend in-app, the industry is for the first time dealing with stalling downloads — especially in the most mature and saturated markets.

Coming down from the pandemic high of cheap installs and a seemingly unlimited user base with endless reserves of time they’re happy to spend in-app, the industry is for the first time dealing with stalling downloads — especially in the most mature and saturated markets.

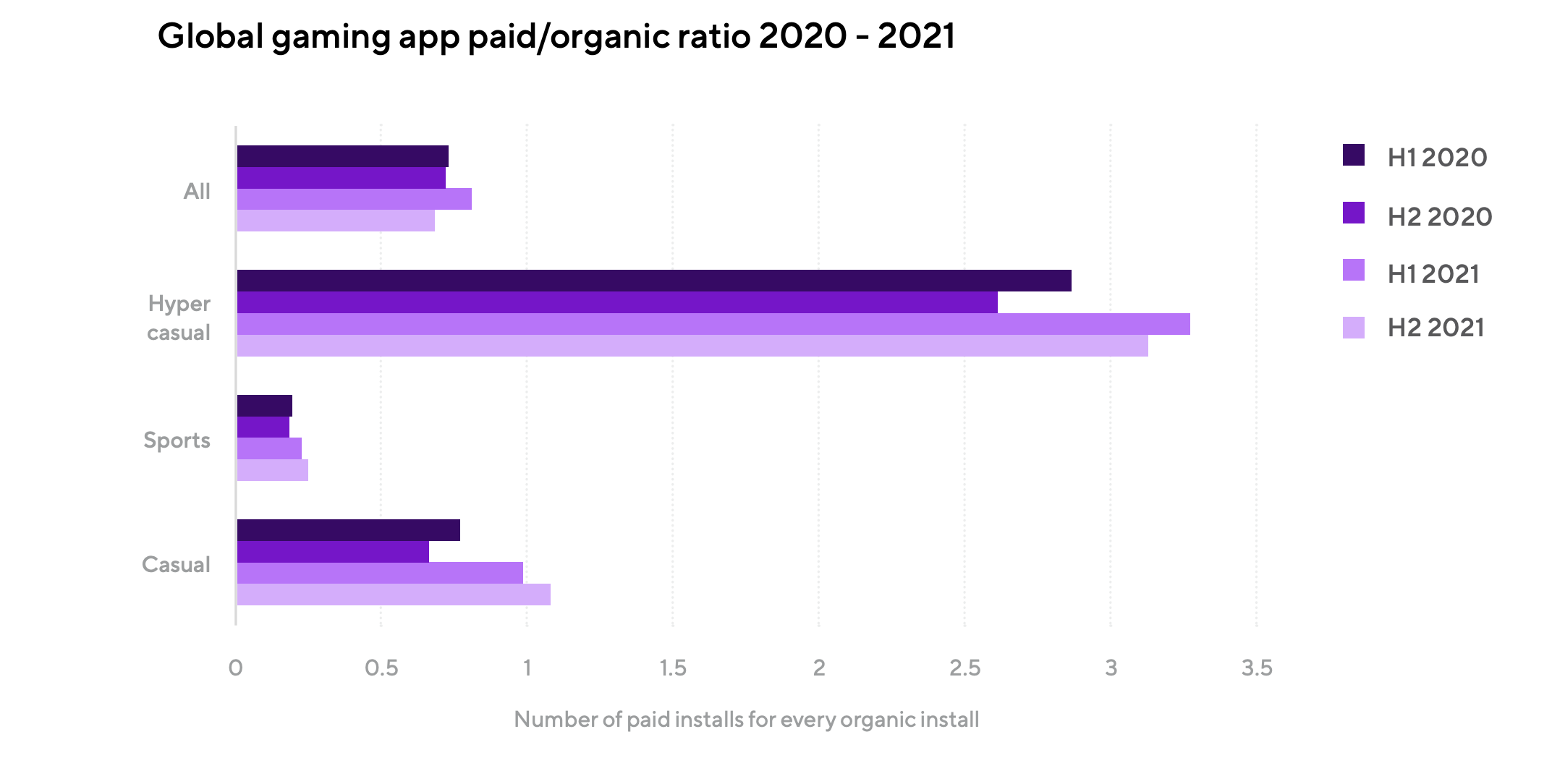

That spells tough times ahead, especially as it pertains to studios specializing in hyper-casual fair. These studios rely on cheap UA to fuel the stars of their portfolios; stars that tend to burn bright albeit briefly.

When COVID-19 was at its worst, UA costs were at their best. And as soon as things began looking up on the public health front, they began looking down on the UA front. Already by the beginning of 2022, the average cost per install (CPI) of iOS apps had increased by some 50%. Throughout 2022, UA spending increased by 24.8% and it's expected to grow another 15.5% in 2023.

With all that money still pouring in, the laws of supply and demand make it unlikely that costs will fall significantly any time soon. This will make it harder to acquire new customers and to keep existing customers if your retention strategy relies heavily on cross-promotion.

This too bodes particularly badly for hyper-casual app makers, as their installs come disproportionately from paid activities.

Of course, this comes as no surprise. The writing’s been on the wall for a while. In fact, it was our top takeaway from last year's industry analysis. Unfortunately, there's no simple way forward for hyper-casual studios, as they become increasingly reliant on cross-promotion.

Of course, this comes as no surprise. The writing’s been on the wall for a while. In fact, it was our top takeaway from last year's industry analysis. Unfortunately, there's no simple way forward for hyper-casual studios, as they become increasingly reliant on cross-promotion.

TREND NO 2: The market is consolidating

This is not a totally new trend, but it definitely hit new levels in 2022 and is likely to continue on that trajectory for some time still. In the last year, industry M&As exceeding the $100B mark — reshaping the lay of the land both in terms of technology and publishers. It's clear that the big names are looking to maintain their dominance through M&A activity.

Whether it's Mopub, ironSource, Activision Blizzard, Zynga, Bungie, Within, Sumo Group, Playdemic, Moonton Technology, Embracer Group, or Glu Mobile the trend is catching like a wild fire and we're seeing big time players gobbled up and subsumed at a dizzying rate.

As if the manmade push toward consolidation weren't enough, there seems to be a corresponding market-made pull that is just as powerful. Top publishers have always held a disproportionate share of market downloads and revenue, but it's kicked into a new gear of late. Currently, the top 1% of publishers account for 91% of app revenue and 79% of downloads. Take a moment to let that profound imbalance sink in.

Of course the previous trend — that of more difficult and expensive UA — also works in favor of market-dominating players. With eCPI on the rise, those with the most existing downloads and the deepest pockets hold the advantage.

In many ways, it's a tremendously hostile environment for smaller app makers and growing more hostile by the day. Yet there are also signs pointing in the opposite direction, suggesting that the market may be opening up.

As counter-intuitive as it may seen, the march toward consolidation can lead to an opening of the competitive field. It will lead to an abatement of the prevailing over-saturation as consolidation cuts down on the number of competing offerings in the marketplace. The little kid on the playground gets more breathing room whenever two big kids get replaced with one — even if the one is twice as big.

The market will also see relief from over-saturation as the flood of hyper-casual games brought on by the pandemic naturally recedes. The issue is also being eased by a parallel "cleanup" of the stores. 2022 saw Google and Apple delist an unprecedented number of apps. In Q4 2022 alone, Apple delisted 8% of all App Store apps while Google removed 4% of Play Store apps.

In total, 1.4M apps were delisted, with an almost even split across the App Store and Google Play. And it's not just about cutting dead weight. The removed apps are estimated to have drawn a combined $180M in yearly ad spend. That’s revenue that will be redirected to other apps better designed to stand the test of time.

At the same time, the market is opening up in other ways too. BigTech companies are facing increasing criticism for their anti-competitive tactics and market strong-arming. Google and Apple in particular suffered serious damage to their public images from their fight with Epic. With popular sentiment against them, political action is now mounting — at least in the US and Europe — to weaken BigTech's hold on the market.

And we're already seeing big changes. In 2021, Apple officially dropped their cut of App Store transactions from 30% to 15% for developers making under $1 million. Within several months, Google announced a similar change to benefit smaller developers. By the end of 2022, Apple even opened their phones to allow for apps to be "sideloaded" from outside stores — something utterly unthinkable only a couple years ago.

So while the app market may be deep in the embrace of consolidation, it won't necessarily spell the end of scrappy studios or startups.

TREND NO 3: Diversifying revenue in the face of a stiffening monetization scene

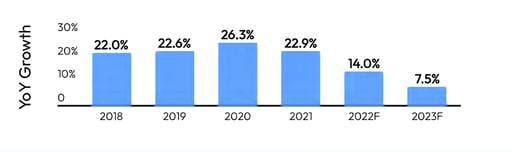

According to data.ai's market forecast, mobile ad spend in 2023 will grow at barely half the rate it did in 2022 and a third the rate of 2021.

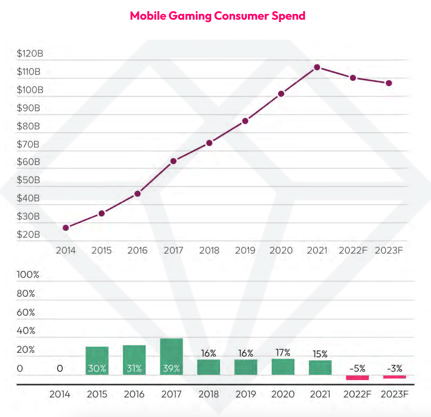

Worldwide, Google Play user spend fell for the first time ever in a decade. And while forecasts vary, data.ai expects the downward trend to continue through 2023.

Worldwide, Google Play user spend fell for the first time ever in a decade. And while forecasts vary, data.ai expects the downward trend to continue through 2023.

So we're looking at slowing and reversing growth on each of the two primary fronts powering app monetization.

On top that, it's expected that recent privacy changes will continue to impact the market, making monetization more difficult.

We're still adjusting to Apple's 2021 IDFA changes and we haven't yet come to grips with Google's Privacy Sandbox, set for a phased release starting in 2023. Both these changes share a common theme of enhanced privacy and user control and both will likely bear a similar market impact. Specifically, they'll make it harder for advertisers to target high-spending users, which in turn will:

- Erode ad value and drive eCPMs down

- Stymie efforts to compel gravy-making in-app purchases (IAP)

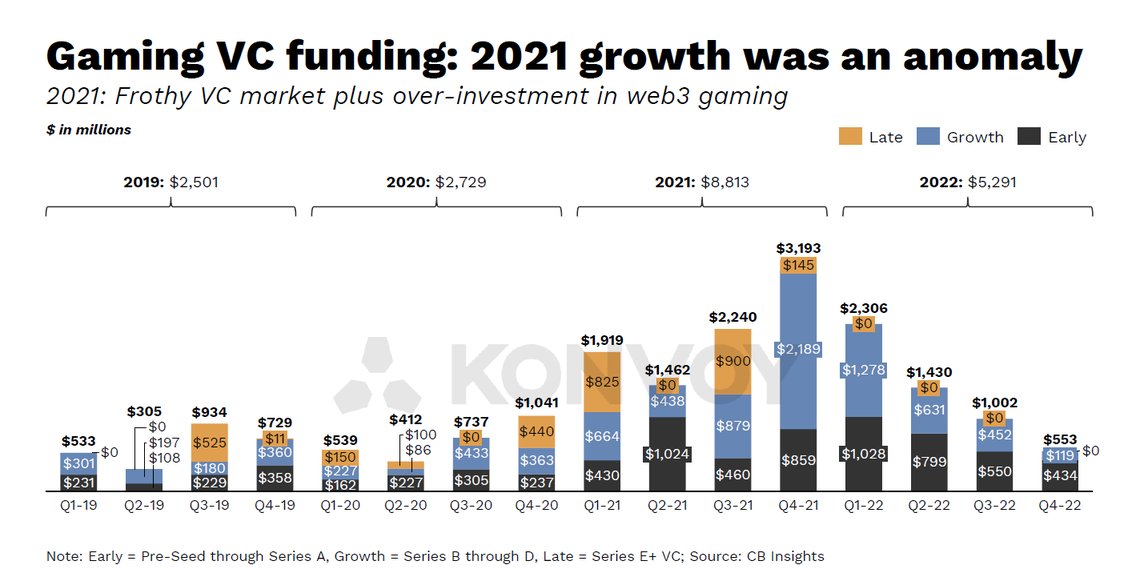

Both outcomes meaningfully complicate monetization. Adding insult to injury, as monetization becomes considerably more difficult, it's also becoming considerably more critical. That's because the most significant alternative revenue stream available to app makers — venture capital — is drying up. And game publishers in particular are taking it on the chin.

That a very big deal. Especially when you consider that many app businesses are built to grow fast now and worry about monetization later. A business model like that really only works when you have OPM to keep the lights on. This is another wind that will blow to the benefit of the big players and detriment of small developers.

As if that weren't enough, app makers also need to contend with a revolving door of arbitrary constraints, like when Google decided to disallow full-screen interstitial ads during gameplay. Poof! Just like that some of the industry's best (most monetizable) ad inventory disappeared overnight.

Facing all these powerful headwinds, revenue diversification is rightly shooting to the top of the agenda for app makers. That might mean introducing in-app advertising (IAA) if you until now you've primarily relied on IAP, and vice versa. It might also mean charging users to download your apps or embracing some sort of freemium model.

Many app makers are also toying with subscriptions. Subscriptions give users access to a bank of apps in return for fixed monthly fee. The idea — aside from providing another revenue stream — is to add value for users while improving retention and facilitating a sort of built-in and effortless cross-promotion. As such, it's liable to emerge as a favored strategy for hyper-casual app makers.

Similar in spirit to subscriptions, publishers are also experimenting with a cross-portfolio approach to IAP. Here, the idea is to make purchases transferrable across different apps. Publishers adopting this approach contend it lowers the psychological barrier-to-purchase and encourages users to kick the tires on other portfolio offerings.

Many are also looking at third-party partnerships as a way of diversifying revenue. An increasing number of publisher are partnering with Kindred for Business, for example. Kindred creates a bridge between app experiences and eCommerce activities. Users receive special discount offers for online purchases and earn in-app rewards for each transaction. Participating apps meanwhile claim a share of the revenue they generate. Advocates of these sorts of creative third-party arrangements say they're able to increase engagement, retention, and ARPMAU without compromising the user experience.

Of course, none of these strategies are mutually exclusive and smart publishers will think of it as a monetization buffet — taking a little of this and little of that, sometimes mixing them together to form an entirely novel creation.

The Trends You Know: Friend or Foe?

As the world gradually moves beyond the pandemic, we must recognize that what worked in the past may not necessarily work in the future. This is especially true when it comes to the business of apps, where changes tend to be both fast-coming and deep-cutting.

To stay competitive and top of the heap going forward, app makers must keep a close eye and analytical mind on emerging trends. But the fact is that trends have no agenda and no feelings. They simply move in a given direction and move the market with them. They can work for you or against you. It's your choice.

It all depends on how you anticipate them — how accurately and from how far out — and how you build for/around them. Of course, we didn't get too far into how app makers should build for/around the trends we listed. But don't worry, this is only the first installment in a two-part series.

Here, we've endeavored to define the most significant trends emerging from and shaping the app industry. In the second installment we reconsider these trends with an eye toward action — pulling out specific take-aways and exploring how they might help shape strategies for 2023 and beyond.